Bypassing the Grid: How Data Centers Are Building Their Own Power Plants

An analysis of 46 behind-the-meter data centers and the equipment powering them

This post was originally published on the Cleanview newsletter, which I also write. I’m sharing it here with Distilled readers given that I think many of you will be interested in the topic.

Many data centers claim to use clean energy to power their operations. But in a report Cleanview published today, we found that’s increasingly not true. Instead data centers are using natural gas—and doing so in very strange ways.

It can now take as long as 7 years to connect a data center to the power grid. Beginning about a year ago, developers began pursuing new power strategies. Rather than wait, many data centers are now building their own power plants.

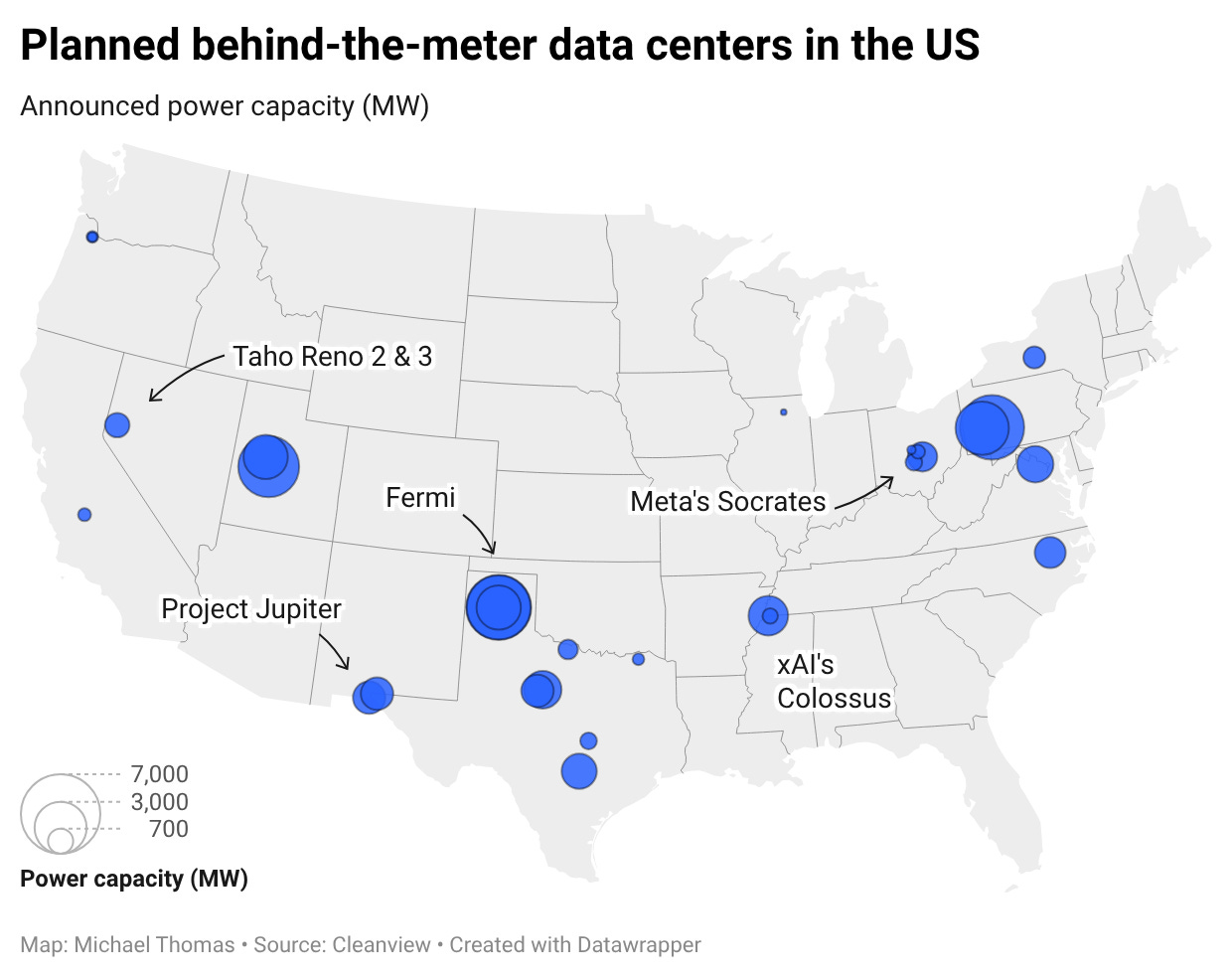

In what we believe is the most comprehensive analysis of this trend to date, we identified 46 data centers with a combined capacity of 56 GW that plan to build their own power “behind-the-meter.” That represents roughly 30% of all planned data center capacity in the United States, according to Cleanview’s project tracker.

In the last year, this trend has gone from niche to mainstream. 90% of the projects we identified—representing approximately 50 GW—were announced in 2025 alone. A year ago, behind-the-meter data center power was a curiosity, embodied by xAI’s controversial decision to truck mobile generators into Memphis. Now it’s an increasingly common development strategy.

When we began this research, we were skeptical of many of these projects—as all analysts should be. Data center developers often pursue multiple projects with the intention of only building one (the “phantom project” phenomenon). Turbine manufacturers have said lead times for their equipment now stretch as long as 5-7 years. Local opposition to data centers is rising.

But we think much of this capacity is likely to come online soon. Many of the projects we identified are already under construction—in some cases with crews working through the night. Many of those that aren’t under construction have been permitted and have placed equipment orders.

We were able to identify specific equipment deals at approximately two-thirds of the projects we tracked—commitments to manufacturers like GE Vernova, Caterpillar, Siemens, and Doosan that signal serious intent.

What makes our report unique is that we didn’t rely on press releases, which show what developers say they are going to build. Instead we tracked down actual equipment deals and permits showing site plans.

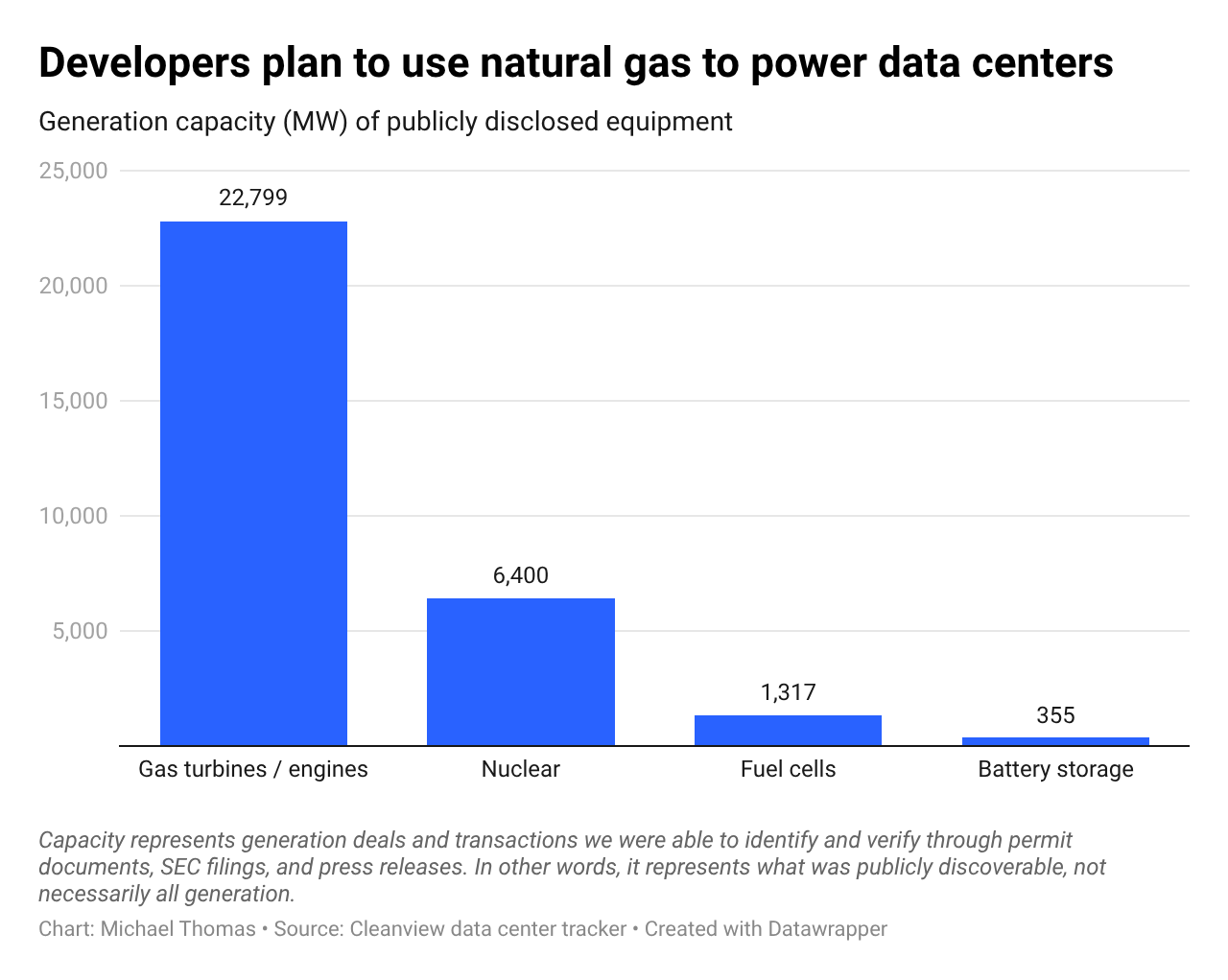

This revealed a very different—and surprising—story. Most of the press releases we found mentioned “all of the above” strategies that include renewables. But ~75% of the generation equipment we could identify (23 GW) was natural gas-powered. Virtually none of the developers planned to build renewables in the short term.

But data centers aren’t planning to use your typical gas turbines—hence why many are able to install them this year or next year. Data center developers are instead turning to:

Mobile gas generators strapped to semitrucks

Aeroderivative turbines originally designed for aircraft and warships

Reciprocating engines that ramp fast, but are less efficient

Refurbished turbines acquired from industrial operations

In our research, we came across a company that typically sells cruise ship engines that struck a deal to power a data center. One developer, unable to secure enough conventional turbines, placed a $1.25 billion order with Boom Supersonic—a company that has never sold a power generation product. Elon Musk’s xAI famously drove in semitrucks with natural gas generators on the back to build what was at one time the world’s largest data center.

On the surface this makes no sense. These are less efficient technologies and the power will cost far more. But an AI data center can earn as much as $10-12 billion per GW. Getting online a few years early can result in a windfall. Power generation efficiency is out. Speed to power is all that developers care about.

As a company, our main job is to track data centers and power projects. Still, much of this data shocked us. The public narrative is that data centers are waiting for grid connections and 5-7 year turbine backlogs. But that narrative is lagging what is actually happening on the ground in rural counties across the country.

To read the full report, you can head to our website. We’ve released both a free summary and a ~50-page paid version with two datasets. We also have a discounted option for nonprofits and researchers.

This is terrible news, though not surprising. Almost no equipment purchase or permit evidence suggesting renewable energy construction underway at data centers? Goddamnit! Come on, people! These days I always share this link from @KatharineHayhoe when this topic comes up https://katharinehayhoe.com/www-katharinehayhoe-com-ai-climate-change/ It's titled "When AI hurts the climate—and when it helps" but this research right here points to a real problem. The choices being made by developers!

Michael, thank you for sharing this information with small non-profits like the one represent (Sustainable Newton) who can't afford to purchase the report. We are actually aware of and working to oppose a project in Covington, Georgia using RICE engines. I don't see any projects identified for Georgia in your map or summary report. The company, VoltaGrid, has applied for an air-quality permit from the Georgia Environmental Protection Division (EPD). The AJC reported on the project here -- https://www.ajc.com/business/2025/12/a-new-georgia-data-center-could-be-powered-by-rice-its-not-the-kind-you-eat/. Sustainable Newton joined the Southern Environmental Law Center (SELC) and the Altamaha Riverkeeper to file comments on the VoltaGrid application with EPD. I can send you those comments if you can provide an email address or other way to get them to you.