New Clean Energy Tax Rules and Trump's Policy of Energy Scarcity

The IRS just released their long-awaited rules on how solar and wind projects can qualify for tax credits.

I’m not sure what I expected when I started working on clean energy and climate about 7 years ago. Sure, I didn’t think I was going to be drilling for ice samples in the Arctic or hugging trees everyday. I know one thing: I didn’t expect to be reading through so many long PDFs about tax law.

Anyway, it’s about 4pm as I’m writing this and I just finished reading through the latest dry-yet-very-consequential tax document. This time it was the latest Treasury Department guidance on how solar and wind projects can qualify for important tax credits over the next year.

The upshot: The Trump adminstration just escalated its war on renewable energy. The new rules could result in 60 GW less clean energy over the next five years, according to an analysis from Clean Energy Associates. To put that in context, the US built 42 GW of clean energy capacity in 2024. 60 GW is the equivalent of 60 nuclear reactors. 60 GW of lost capacity is about $100 billion less investment in communities across the US. It’s a lot.

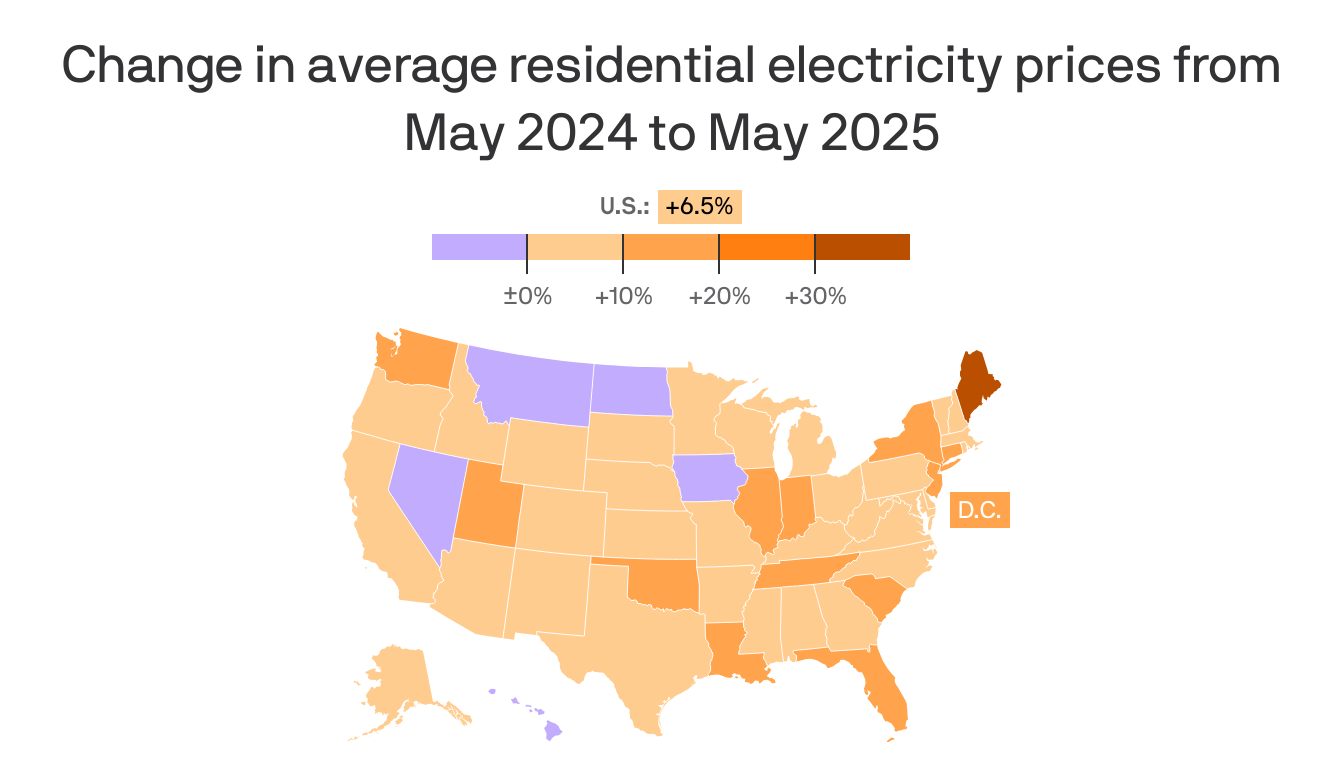

The US can’t really afford to lose this capacity either. Electricity demand is growing faster than it has in decades due to AI data centers, manufacturing reshoring, and electrification. When demand goes up and supply goes down (or doesn’t go up enough), prices go up.

Every American individual and business that pays a utility bill will feel the impact of the Trump adminstration’s attacks on renewable energy. In some states electricity prices are already rising by more than 25% per year. They’ll rise even more over the next few years because of deliberate decisions by Trump and the Republican-led Congress.

Democrats should hammer Republicans on this point over the next year in the run up to the 2026 midterms. One can debate how much the average voter cares about climate change. But there’s no doubt affordability and inflation are top priorities for virtually every voter right now. For all the adminstration’s talk about “energy dominance,” it’s actual policies are resulting in energy scarcity.

The new Treasury rules, explained

For those who haven't been following this saga, here's a quick summary of how we got here and why Treasury rules could mean the difference between billions of dollars of investment in clean energy.

Last month in the heat of the debate over Trump’s big tax bill, Republicans reached a compromise. The bill would phase out clean energy tax credits, but give developers a 12 month runway to secure tax credits so long as they started construction on their projects. Longstanding IRS rules have defined “begun construction” as either doing “physical work” or spending at least 5% of a project’s capital and then making progress on the project over four years. This was meant to be a slow and steady phase-down to avoid pulling the rug from under American businesses and investors.

But Trump and far-right extremists in the party made a backroom deal—unbeknownst to more moderate Republicans like Sen. Lisa Murkowski (R-AK) and Sen. John Curtis (R-UT) fighting for clean energy. If the far-right voted for the bill, Trump promised to have his Treasury Department rewrite the rules on what "begun construction" means. And that’s just what he did the Monday after the big bill passed.

Today the Treasury Department released those new rules. As expected, given the adminstration’s recent attacks on renewable energy, the Treasury guidance was pretty draconian.

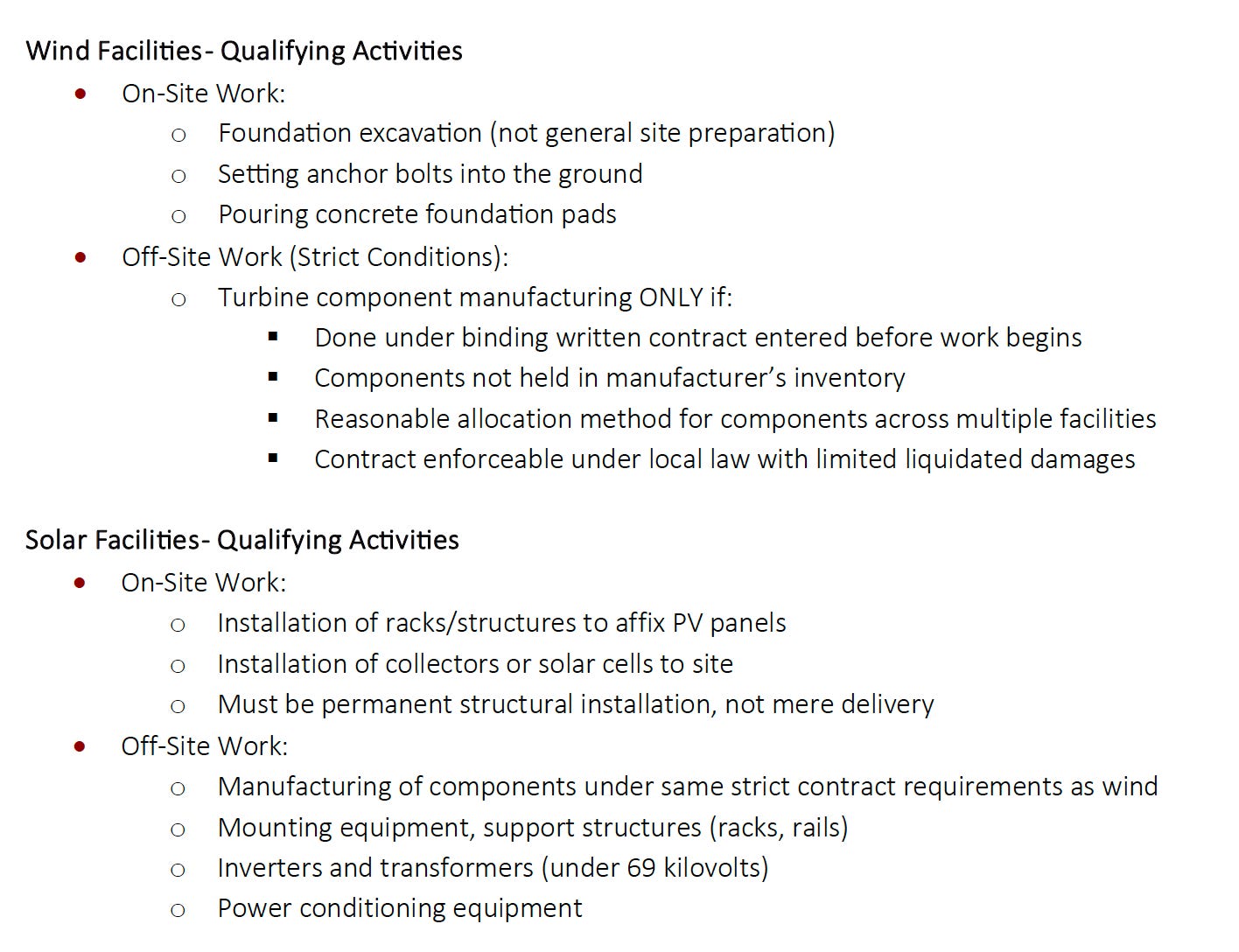

The new rules eliminate the “5% safe harbor” meaning the only way most solar and wind projects can qualify is through a “physical work test.” But the adminstration tightened their rules for what constitutes physical work.

Here’s a summary of those requirements from the lobbying firm BGR Group:

Projects using the Physical Work test must make continuous progress for up to 4 years to qualify. The rules for what constitutes progress got stricter too, according to BGR’s analysis.

Why some people feel better about this than I do

All of this sucks if you’re a clean energy developer who can’t pour concrete in the next 12 months because your project is stuck in permitting hell, for example. It sucks if you care about keeping electricity affordable. And it sucks if you want to see the US reduce its carbon emissions. But it wasn’t as bad as some people expected.

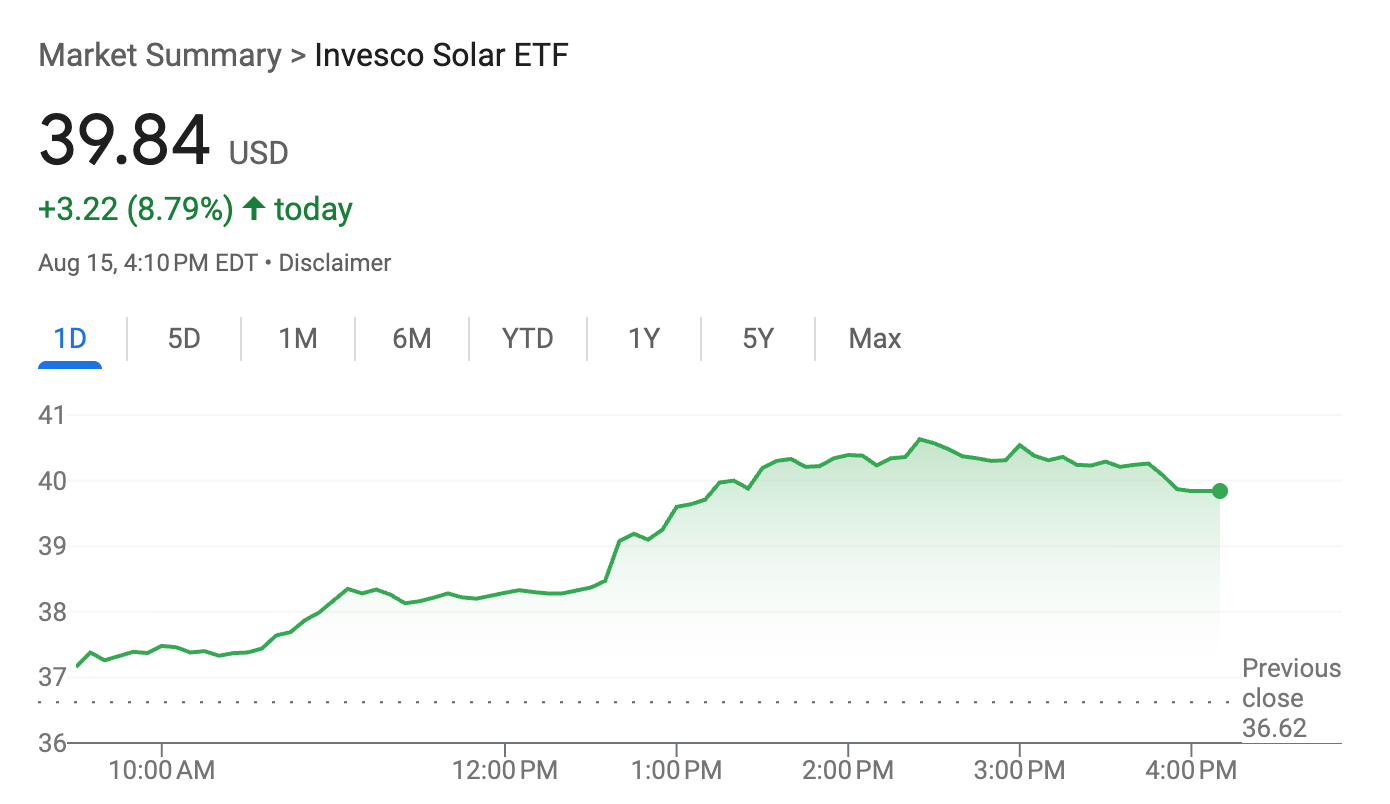

Solar stocks rose significantly following the Treasury announcement. The general consensus I’ve seen from analysts is that investors worried the new rules would be retroactive, affecting billions of dollars of investments already made by large developers. Capitalists also love certainty and even published bad rules are better than the big question mark hanging over the industry over the last 45 days.

The rules are also surprisingly generous to rooftop solar companies, who will still be able to use the 5% safe harbor strategy. I was a bit confused how this would work initially and asked a rooftop solar executive, who spoke to me on the condition of anonymity, to explain it.

“For residential, passing the 5% test literally just means purchasing the equipment. You don't need to have a customer or address identified yet,” he told me. “So we would just claim credits business as usual until 2027, then use safe-harbor equipment for 2028, 2029, 2030.”

This will likely benefit the biggest rooftop solar companies given that most smaller installers will struggle to find the cash needed to buy four years of equipment in advance.

Still, the new rules will wipe out an enormous amount of potential clean energy capacity and investment. They are another sign that this administration cares more about pushing extreme ideology than it does about growing the US economy, creating good jobs, and lowering utility bills.