America Isn't Pivoting To Natural Gas

Data from Texas shows that renewables are still the main story in America's electricity sector

If you’ve read any news this year about America’s increasingly important electric grid, you’ve probably seen the many stories about our country’s “pivot to gas.” These stories often cite an increase in gas turbine orders and proposed power plants and then include a quote from some analyst like this:

“Gas is growing faster now and in the medium term than ever before,” said Corianna Mah, a power and renewables analyst at data analytics firm Enverus.

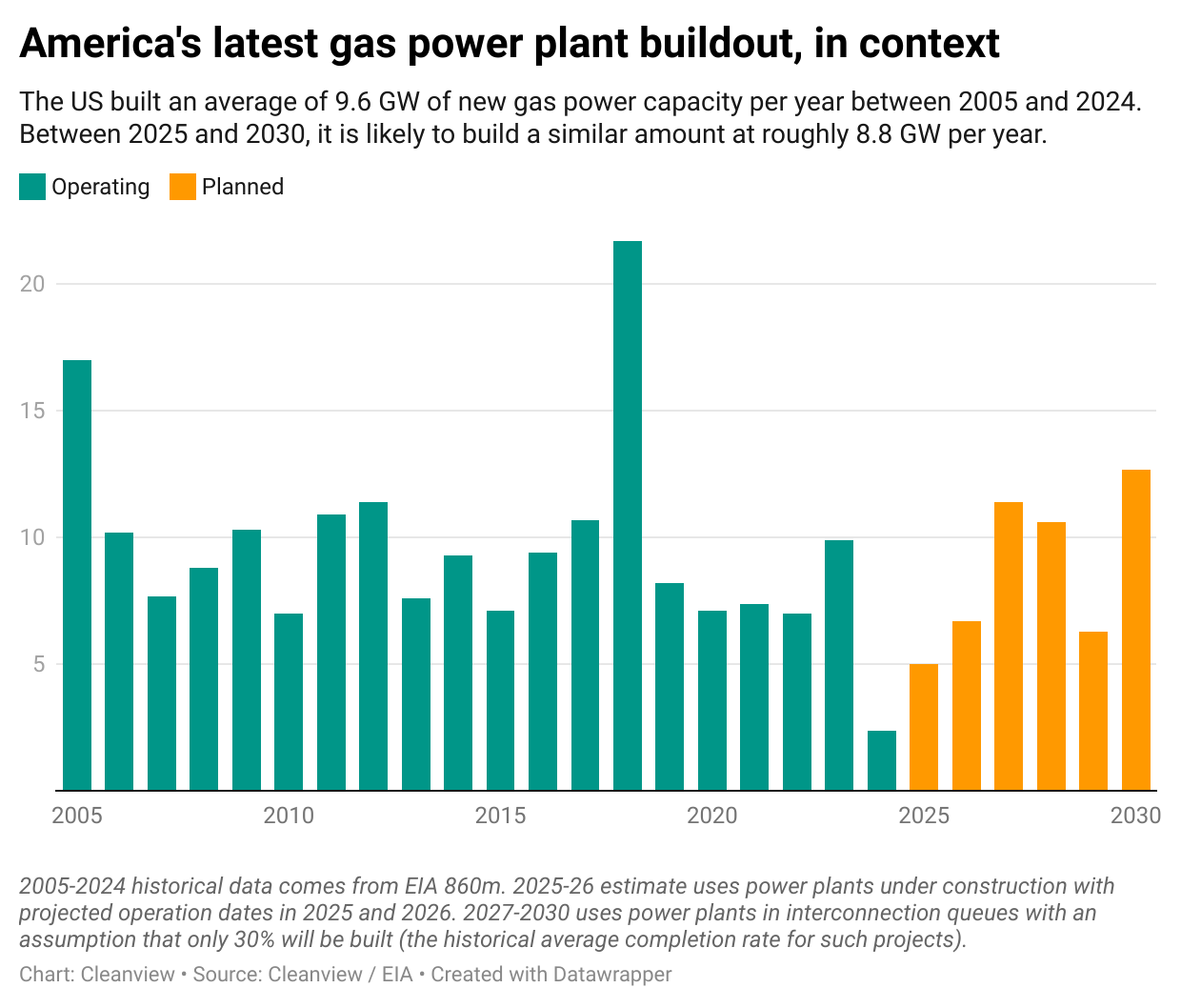

But as I wrote in a story last month, this narrative is misleading. Contrary to the quote above, gas isn’t growing faster than ever before.

In that story, I looked at proposed projects expected to come online over the next few years. Then I compared that to the projects that have come online over the last 20 years. The numbers are almost identical.

The “pivot to gas” narrative isn’t just about the growth of proposed fossil fuel power plants though. It also suggests an abandonment of renewables and storage. That part of the narrative is equally misleading.

Gas is growing, but so are renewables and storage

Using our project tracker at Cleanview, I looked at the projects that developers have proposed in Texas over the last ~10 years. If there were to be an unprecedented pivot to gas, you’d expect Texas to be ground zero for it. The state has done everything it can to prop up fossil fuel power in recent years. It’s also one of the most permissive when it comes to environmental regulations and permitting.

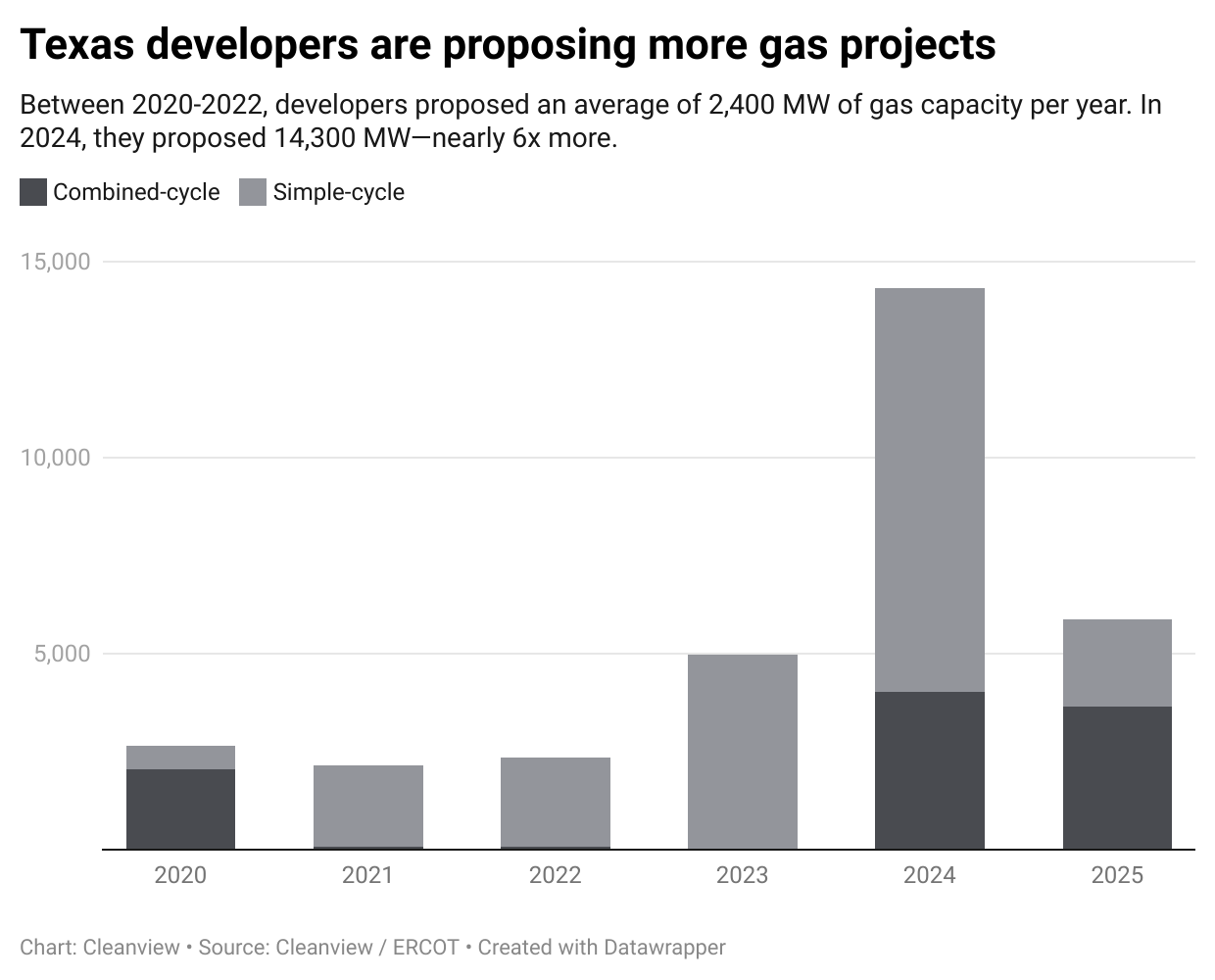

In recent years, the number of proposed gas plants in Texas has risen significantly. Last year developers proposed 14 GW of gas capacity compared to 2 GW in 2022 and 5 GW in 2023. In the first half of 2025, developers have already proposed 6 GW of gas. That's almost as much as they proposed in 2020, 2021, and 2022 combined.

There’s no doubt that gas power is growing. But it’s important to view this growth in the context of the larger electricity market in Texas. In that context, the story is more nuanced.

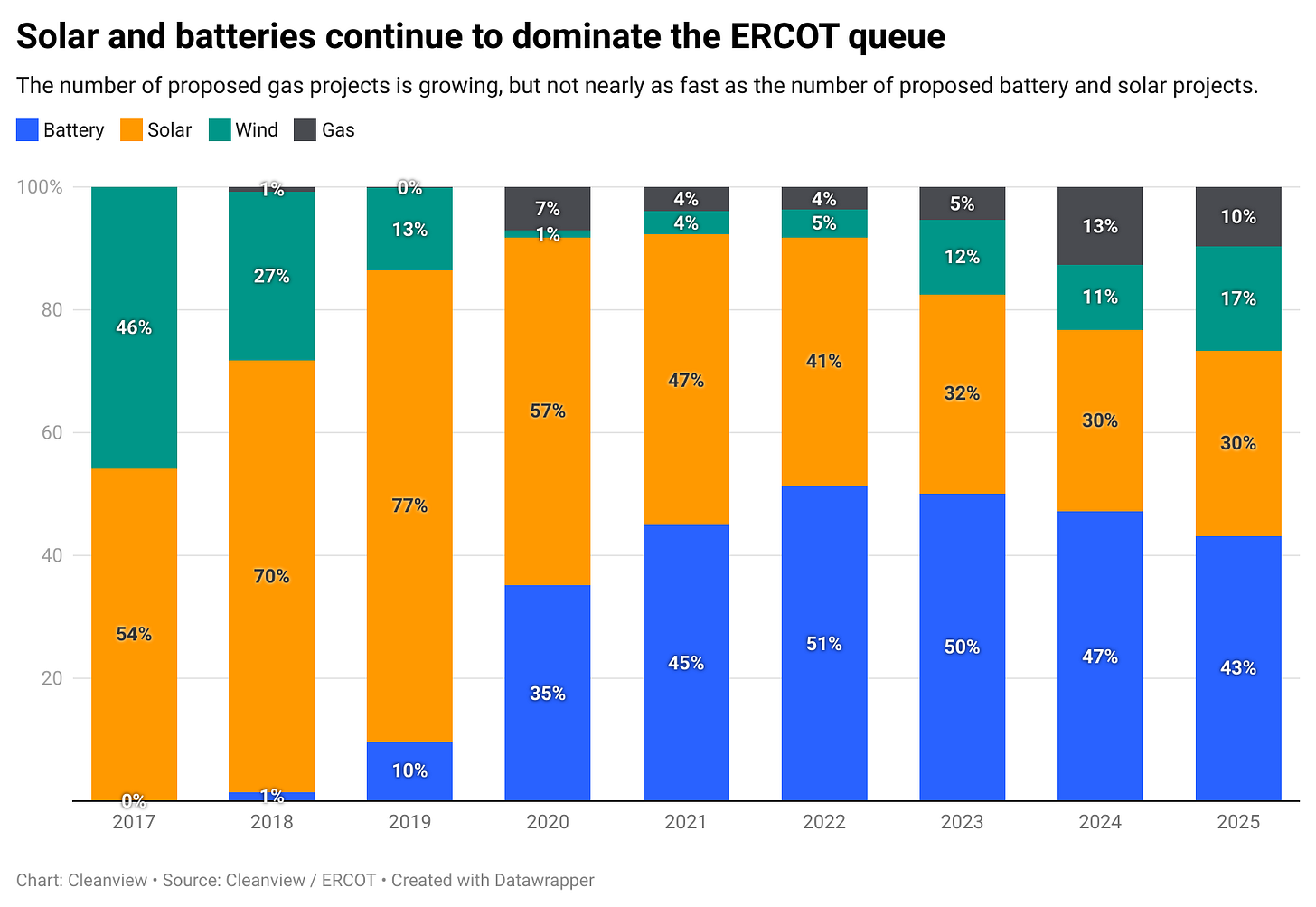

Gas makes up just 10% of proposed project capacity in Texas so far this year. The remaining 90% of capacity is from solar, wind, and battery projects. Last year, renewable and storage developers proposed 100 GW of clean capacity—7x more capacity than gas developers proposed.

I would have thought that amidst all the chaos 2025 has brought, clean energy developers would be proposing far fewer projects in Texas. But that hasn't been the case so far. Proposed projects through July are just behind 2025's record year and ahead of 2024 and 2023's massive years, according to Cleanview’s analysis of ERCOT data.

Why developers haven’t pivoted away from renewables

Developers haven’t pivoted away from renewables in Texas because of the many advantages solar, wind and batteries have compared to natural gas power.

Electricity demand is rising faster in Texas than nearly anywhere in the world—even China. The state will see demand grow at a staggering 11% per year in 2025 and 2026, according to EIA.

Renewables and storage offer the only way to meet that demand in the short-term. The current backlog for gas turbines is 7 years long. Propose a massive gas plant today and you can expect it to be built in 2032. Meanwhile, renewables developers are building projects in 12-18 months.

Renewables are also cheaper than gas. It costs $38 to $78 per MWh to build a solar project compared to $48 to $107 per MWh to build new combined cycle gas plants, according to Lazard’s latest report.

Companies sign 20-year long power purchase agreements because they can lock in a relatively low price for electricity for decades. With gas you’re on the hook for volatile fuel prices.

Clean energy can also help companies reduce their emissions. And while the vibes might not suggest it, big tech companies—the largest purchasers of power—still prefer clean electrons to power their data centers over dirty ones.

Many people read stories of Meta supporting a 2 GW gas project in Louisiana and assume Big Tech has pivoted away from renewables entirely. But if you look at the power purchase agreements these companies are executing, the vast majority are coming from renewables projects for all the reasons above.

Renewable energy has no shortage of challenges today. President Trump is doing everything he can—including breaking the law—to slow their development. His tariffs, big tax bill, and executive orders are all threatening to slow clean energy’s growth and jack up all our electricity prices in the process.

But there’s a difference between slowing growth and an outright abandonment of renewables. Trump understands, more than maybe anyone, that there’s tremendous power in narrative. To create the vibe of a thing can bring it closer to reality. The headlines and vibes all point towards a huge pivot to gas. But the data suggests a very different story.

Thanks for breaking "gas powerplants" into simple and combined cycle turbines. Good to see that most of them have been and, to a slightly lesser extent, continue to be, simple cycle. It's worth explaining to the climate-concerned that these are designed and used for what I like to call "backup power." Given existing wind, new solar and newer batteries, they will only be called on during extended extreme peaks of demand or very low renewables production. They can be turned on and off and ramped quickly.

Given that we don't have magic cheap "300 hour" batteries, backup fuel-fired powerplants are an indispensable part of retiring coal plants and increasing renewables penetration where there is still a lot of coal on the grid like the other commenter about Colorado Springs Utilities. Coal powerplants often take up to 48 hours to start up, and then must run at 50% minimum capacity. Utilities want to leave them on if there is any chance of needing them. This places a false floor on variable renewables. They, like nuclear, aren't really "dispatchable," because they can't be dispatched OFF.

Many climate activists hate to see any "new fossil infrastructure." But it's a YUGE improvement to go from 30 or 40% wind with coal and a bit of gas in the background, to 80% wind and solar and batteries with gas making up the remainder. YUGE!

I was dismayed to hear that my local Colorado Springs Utilities planned to shut down its last coal plant in 2029 and now wants to delay that due to cost increases to renewables because of Trump.

We are decreasing the supply of cheap, clean, and quick to implement energy at the same time demand is skyrocketing because of AI and the fear of falling behind China.

Be prepared to pay more for electricity and experience more long term costs to our climate.