Is This How Data Centers Break the Power Grid?

America is investing in data centers much faster than it's investing in the grid that support them

Last month, I wrote a story about why electricity prices are rising, based on a new study from one of America’s top national labs. There were a lot of surprising conclusions in that report. But by far the most surprising one to me was what hasn’t caused electricity bills to rise: data centers.

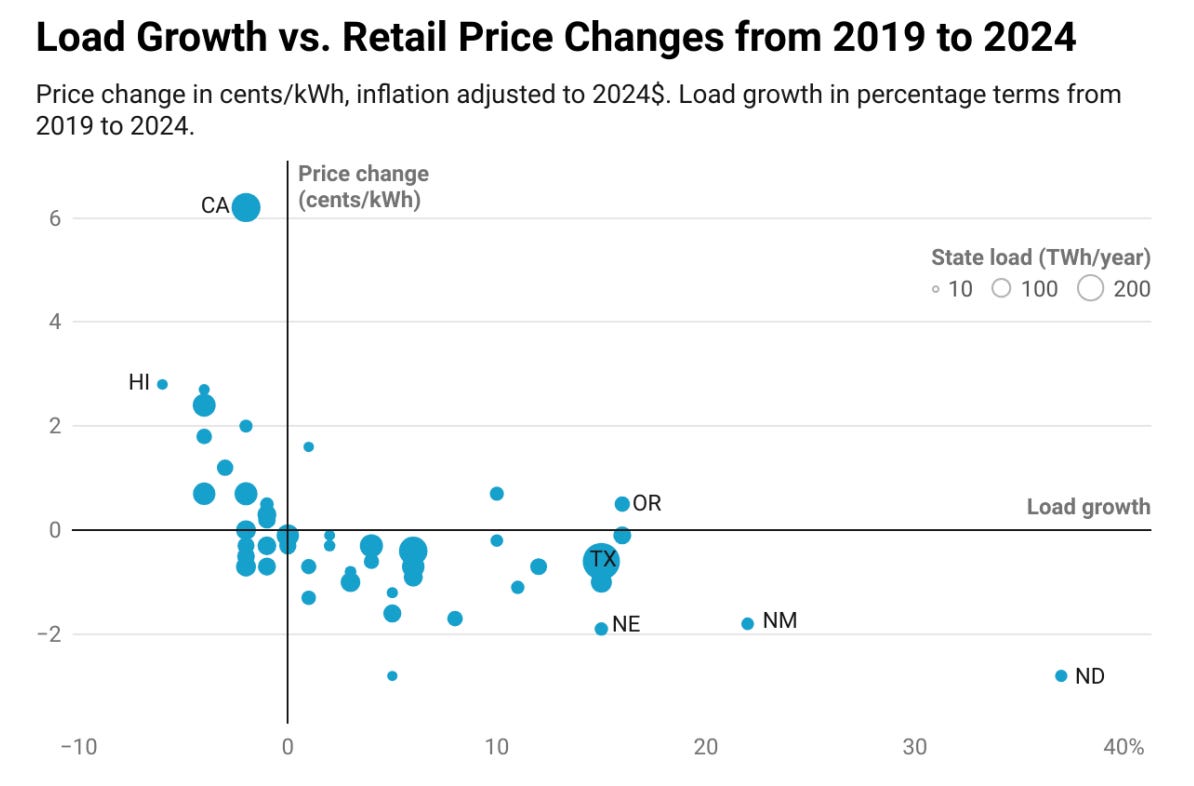

For all the talk about data centers raising utility bills, the report showed something very different. Across the US, states that experienced higher electricity demand—or load growth—saw their prices fall, while states that consumed less electricity saw their prices rise.

In Virginia—home to the world’s largest concentration of data centers—rising electricity consumption from data centers actually prevented prices from rising as much as they otherwise would have between 2019 and 2024, according to the report.

In North Dakota, rising electricity demand from cryptomining, data centers, and oil and gas extraction, helped actually reduce electricity prices, in both inflation-adjusted and nominal terms.

But the authors of the report were clear that this relationship is not guaranteed to exist in the future or everywhere. This is an important caveat given how quickly things are changing. Just a few years ago, it was rare for a data center to be larger than 50 MW. Now there are dozens of 1,000 MW projects planned around the country.

In the country’s largest electricity market, PJM, power prices are already rising due, mostly, to data centers. Some states served by PJM, like New Jersey, have seen their electricity bills rise by 22% in the last year alone.

Much of the discussion about the impact of data centers on the power grid tends to focus on these new sources of demand—and for good reason: These things are massive.

Less attention is paid to how much new supply is added to the grid. This is where so many of PJM’s problems begin. For years, the grid has struggled to bring online new sources of power. Between 2018 and 2023, power plant retirements exceeded new power additions.

To make matters worse, almost none of that new supply came in the form of battery storage capacity. PJM has 440 MW of battery capacity. By comparison, the Texas power grid has 10,982 MW—25 times more capacity on a grid that serves half as many people. There are single battery storage projects in California that have more capacity than PJM’s entire grid.

If data centers break the power grid, their insane electricity demand will certainly be one of the causes. But so will America’s failure to build new power capacity.